Penny Stocks Soaring: Find Big Winners

8 Penny Stocks With Soaring Prices: How To Find The Big Winners Among Average Growth Prospects

Investing in small cap stocks, referred to as ‘penny stocks’, is one of the most exciting and potentially profitable types of online trading, especially for beginners who have little know-how of the way finance markets operate. The main reason that penny stocks have attracted millions of investors from financial markets across the globe – of which there are hundreds of thousands in the UK alone – is the chance to profit from a massive and immediate growth or loss in a stock’s value, something that is less likely to occur in large cap companies that have a well-established reputation within the general public and are traded on leading stock exchanges, meaning they are frequently in high demand (and have a high liquidity value).

In contrast, penny stocks, which are traded in the over the counter (OTC) market have low marketability. The OTC isn’t a physical auction market, but rather consists of online bulletin boards that anyone on the internet can access, resulting in a fully-open marketplace, and, according to regulatory authorities, a lack of transparency. Penny stocks make up the bulk of OTC trading but investors can also choose to trade on commodities such as gold, silver, and crude oil; currencies, indices, and other asset classes; as well as contracts for difference (CFD) of such products.

Finding success in a haystack of fails

The phrase “there’s no such thing as a free lunch” is commonly used to describe the world of penny stocks. Finding the most promising stock out of a pool of unknowns in is an ever going search not to be underestimated. You have to read, and read a lot, before you can hope to amplify your returns tenfold – an achievement successful penny stock traders proudly boast. But, so long as your internet connection works, and so long as you are willing to sacrifice a few hours per week researching the IBM’s and Pfizer’s of tomorrow, this could be the right venture for you.

This is because early stage companies and those encountering financial difficulties, such as a negative cash flow or a disproportionately high amount of spending compared to earnings, may have future growth potential, or loss, that has not yet been noticed by seasoned traders and market analysts. Check out This Website to learn about another noteworthy investment trend for online day traders.

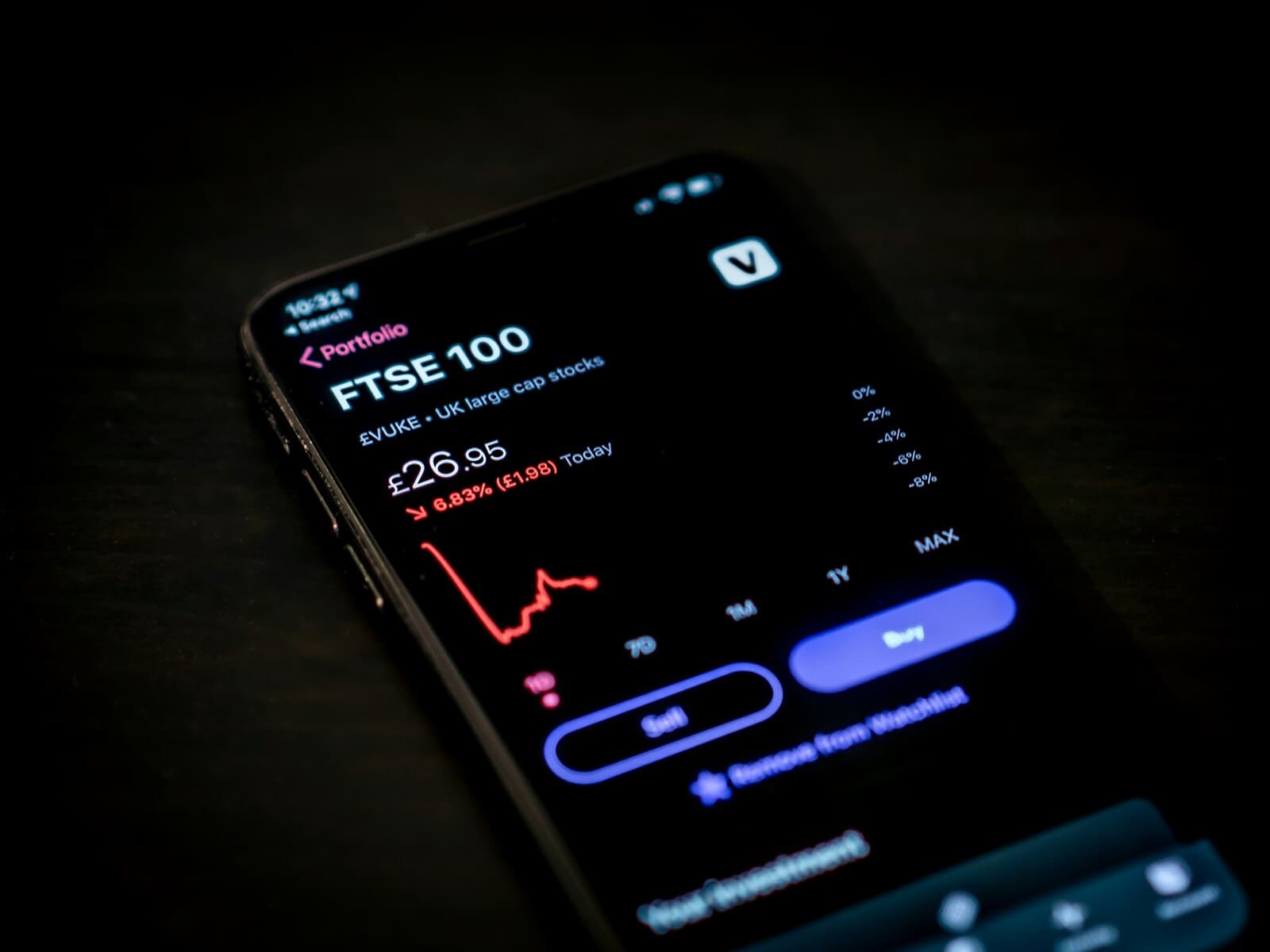

In the United Kingdom, penny stocks can be found on small cap indices such as the FTSE SmallCap Index (an index of 620 small cap companies listed on the main market of the London Stock Exchange), or at the bottom of the FTSE Alternative Investment Market (AIM) AIM All-Share Index. Compared with the 5.6% gain in the last 3 years for the FTSE 100 (an index of the 100 large cap companies listed on the LSE), the AIM has only seen a 2.8% rise.

When looking at the last five years, the numbers are even better for the FTSE 100, which is 8.3% higher. AIM, on the other hand, is down 6.7%. But that’s only half the story. We’ve drilled down for a deeper and it seems one group of 50 penny stocks delivered an averaged 55% rate of return – much better than the 100 constitutes of the FTSE, in any given timeframe. With that said, it should be noted that whilst the potentially higher rewards in penny stocks, all LSE indices, of both large cap and small cap shares, marked up record highs in 2016. FTSE 100 broke through its dotcom bubble peak, hitting a new record high of 7,100 in December, and has stayed close to that level since. Similarly, AIM scaled last year to its highest peak since 2013 as traders remain optimistic about stock growth in the UK.

An overlook of the best penny stocks

In recent years some of the small cap companies to dominate Britain’s penny stock lists include medium-sized biotech/pharma companies with market capitalisations ranging from 50 million to half-a-billion, as well as publicly traded equity firms with a stock priced under £1.

In the table on the right are the top 8 performers that have surpassed market expectations and proved to be solid buys over the past 5 years. All have now climbed in price value by more than 250%. Yes, that’s correct: two hundred and fifty percent!

Screening data found on Hargreaves Landsown, a financial service company, shows that over the past 12 months, one group of 110 penny stocks valued at between £1 and £100 million delivered an average return of 38 percent.

At the top of the list is Norcros PLC (NXR) which has an operating cash flow to overall debt ratio of 50%. That means its total debt is well covered. The company’s principal activities include development and manufacture of home consumer products; its market cap is £94.3 million and current value price (as of March 28) is 148.62GBX, indicating a whopping 1,388.37% yield. NXR is followed by 4imprint Group PLC (FOUR), an online distributor of imprinted merchandise such as clothing and pens that gained close to 500 percent in 5 years, and closed 2016 with a record high of 1,900 points. Elsewhere, shares of Japanese investment trust, Baillie Gifford Shin Nippon PLC (BGS), have delivered 136.2% over the period, nearly twice the returns reached by its closest rival

Being careful in the penny share minefield

Sounds great, right? Well, before you get too excited and start penny share trading, you should keep in mind that this form of investment comes with a very substantial risk. High gains also mean high losses.

Due to lack of liquidity, and a limited number of buyers and sellers in the market, penny stocks can often be difficult (and costly) to trade. Plus, you want to make sure you’re only trading with a website that can guarantee you both high liquidity and mark-to-market leverage.

Penny stocks can also be financially stricken and may even get delisted from the stock market. So investing in them is clearly not for everyone, and should be limited to the more speculative traders who have the willingness to take risks, and a keen interest in digging through the numbers.

If you’re looking for a reliable investing alternative, you might want to consider opening an online trading account at Fortrade Limited. The UK-based brokerage firm is authorised and regulated by the Financial Conduct Authority (FCA) , meaning your money is protected at all times and you are you covered up to £50,000 per investment by the Financial Services Compensation Scheme (FSCS).

Fortrade has free, easy-to-use forex and stock trading apps for Web , IOS and Android.

Comments: 0